Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Not happy with your investing returns? Looking for ways to give those returns a nice bump?

Some research found that dropping dead might be the way to do it.

Okay, not quite. But not too far off from reality. Allow me to explain…

This concept comes from a Bloomberg Radio program where they were interviewing an asset manager. He was talking about all the ways folks screw themselves over when it comes to investing their hard earned dollars.

One little ditty he shared was from research conducted by Fidelity. As the story goes, Fidelity did a study to find which accounts had performed the best.

Now they didn’t really find the owners of the best performing accounts were dead. But what they did find was those account holders FORGOT they had an account with Fidelity!

Meaning, those with the best investing returns didn’t touch the investments in their accounts for a VERY long time.

Which adds weight to those who champion the buy and hold strategy for investing.

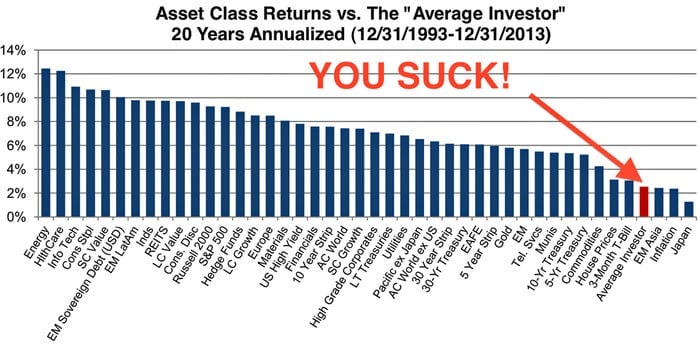

The sad truth is, most people seriously suck at investing. Just look at this chart from Richard Bernstein Advisors. It shows the returns for most of the major asset classes and then shows what the average investor’s return was.

Yikes!

The main reason for this is that we humans are emotional creatures. And when we see the market tanking, we sell. When we see it rising, we feel good about buying.

Over a lifetime of investing, continuously buying high and selling low will neuter your investment returns.

So how do you avoid this trap?

Here are a few pieces of advice…

1. If you’re not an experienced investor or don’t have time to research investments (and no Chuckles, the “hot tip” you got from Reddit doesn’t count), then stick to putting your money in low cost index funds.

2. Don’t touch those investments unless you need the money. Just ride the ups and downs of the market. Remember the lesson above about returns from dead folks.

3. With money you can afford to lose, invest in some stocks and build your investing knowledge over time using sites like this one and others to getting smarter about how you invest.

4. As you get more savvy about investing, then try some shorter term swing trading or day trading strategies. Again, with money you can afford to lose.

And, you know what? If you wanna skip #3 and #4, that’s totally okay.

Just pretend you’re dead (only when it comes to investing and, maybe, with that crazy ex) and you’ll get way better returns than most.