Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Stock Analysis is a big business. There are no shortage of analysts that compile reports and issue recommendations on stocks.

But should you listen to them? Or are they mostly full of sh!t?

As you can probably guess from the headline of this post, we come down on the “full of sh!t” side of things. Why?

Take a look at the following screenshots I took in about 10 minutes in my brokerage account. They show news stories from various stocks. And they include upgrades and downgrades that various analysts have given these stocks over the course of no more than a week or so.

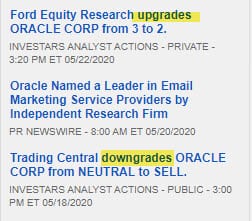

First is new from Oracle, the behemoth software company.

On 5/18, one analyst didn’t like what they saw and downgraded Oracle. A few days later on 5/22 another analyst decided they like the direction the company is headed and upgraded them.

Here’s one for Stryker, the big medical tech company.

Another tale of one upgrade to buy and one downgrade from buy to neutral. This time a week apart.

Here’s an image of news from Columbia Sportswear. Maybe you’re wearing something from them right now.

These two analyst reports came out a day apart. One upgraded the stock, the other downgraded them.

This one is my favorite. Healthcare Services Group provides janitorial, meal and other admin services to hospitals and other healthcare companies.

They had 5 different analysts weigh in on them over the course of 1 week. 3 upgrades and 2 downgrades. One recommending the stock as a solid buy, another saying you should totally sell.

Stock analysts aren’t totally worthless. Analysts (should) know the companies and industries they follow very well. And, if you felt like it, if you were to read their reports, there would be some helpful insights you could take away from them.

But they ain’t the end all be all.

The make mistakes. They get their calls on a stock wrong. And, depending on who signs their paychecks, they may have their own agendas for recommending a stock or not.

Bottom line is they’re human. And we’re talking about the stock market here where there’s never a sure thing.

Here’s what you should take away from all this…

Don’t blindly believe what the analysts say. Or the financial press or talking heads on TV.

Learn how to make your OWN informed decisions when it comes to investing. Do your own homework. Make your own investing decisions.

That’s why we created this site. To help you learn how to make these investing decisions on your own.

Yes, you’re gonna get it wrong some times. But, as you can clearly see from the above, so do the “pros”.

And if you don’t want to learn how to research which stocks to buy/sell, that’s totally cool. Just plug your money into an index fund. (You’ll likely trounce the investment returns of the “pros” if you do!)